Amazon Fintech Application

Project Role: Sole UX Designer on this project

Worked with: Engineering team, Product Manager, Technical Project Manager, UX Manager, and Accountants

User group: Financial analysts and accounting managers

NDA: This project is NDA-compliant as this case study refers to an internal product, therefore some things will be kept anonymous including the true project name.

Project Brief

Amazon Fintech manages billions of dollars in transactions across all Amazon entities globally. Processes such as Month End Close (MEC) are vital in ensuring that accounts are accurate and timely. This project aims to keep up with Amazon’s rapid growth and ensure efficient accounting by integrating the existing MEC process into a scalable and intuitive internal Amazon tool.

The design process

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

User research

I conducted user interviews with financial analysts and accounting managers to understand the current end-to-end Month End Close (MEC) process as it relates to Transfer Pricing (TP) and to identify the pain points within this process. This understanding of the process helped me brainstorm solutions to resolve the identified pain points and optimize the user experience to help users accomplish their goals for MEC.

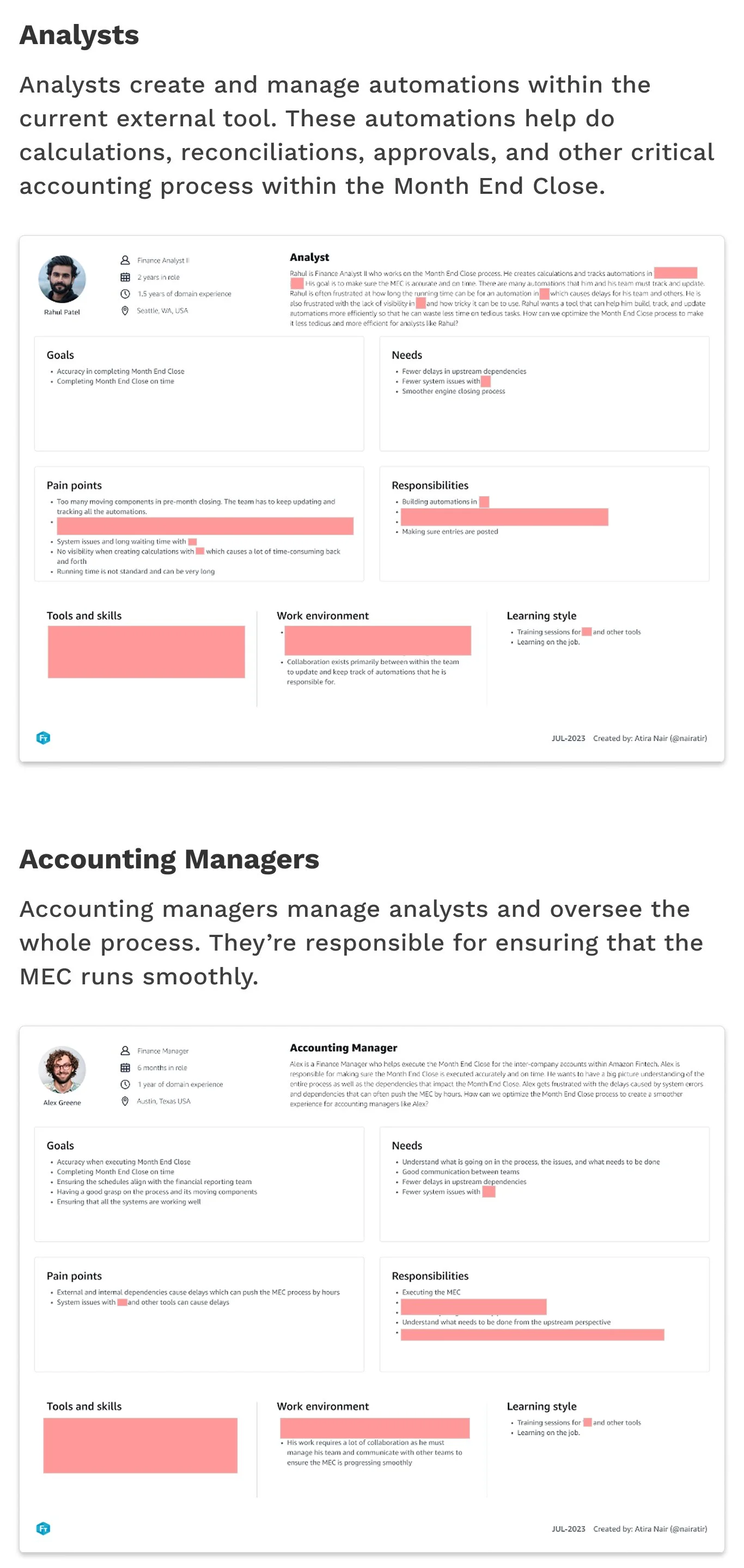

User Personas

Conducting interviews with stakeholders helped me empathize with the user and create user personas that map out their goals, needs, and pain points. We found that:

Both types of users’ main goal is ensuring that the Month End Close is accurate and timely.

The red rectangles are placed to keep potentially sensitive information hidden.

User journey map

After understanding the users and their needs, wants, and goals, I mapped out their current process with a user journey map. This helped me find where the pain points were within the process and where there were opportunities for improvement.

The journey, condensed

Analysts create and manage the automations that perform critical accounting processes. Before the MEC, accounting managers will test run the automations and check reports to make sure everything goes smoothly. Analysts resolve any issues that arise and edit automations accordingly. During the MEC, accountants run automations in groups. Accounting managers check for delays and dependancies during the process. After the MEC, accounting managers do a final check and reverse any calculations or journal entry posts that are inaccurate or have issues. Both types of users consistently check pre-validation and status reports before, during, and after the MEC to ensure that everything is accurate and going well.

The full intricacies of this process will be kept confidential.

The image quality is intentionally blurry to protect confidential information. The red rectangles provide further confidentiality.

Pain points

Both analysts’ and accounting managers’ main goal is to ensure that the MEC is always accurate and timely, however this is hindered by several issues, listed below:

Design

Solution

The solution to ensuring the MEC is accurate and timely came about through various iterations and sessions with stakeholders, PM’s, and engineers. This diagram shows the solutions that address each pain point. Much of the focus was on providing an easily accessible way to view and download reports, automating manual tasks, simplifying navigation to allow users to move between tasks smoothly, and ensuring that the system was intuitive.

Iteration and Brainstorming

I worked closely with users during the initial design stage. Once I mapped out a solution, I got to work on creating mockups that implemented these solutions. Each set of mockups was shown to the PM and engineers first, then to users to get critical feedback. After feedback, I would adjust the design and repeat this process several times. Iterating on the design in this way allowed me to brainstorm all possible options to implementing the solutions as well as test whether the solution was effective.

Evaluation

I evaluated the final sets of mockups with users via user testing. I prototyped these designs on Figma and had users perform a short set of actions that I wanted to test out. The usability testing helped users get a feel for how the system would work and allowed me to see opportunities to make the tool more efficient.

This led to several changes in the original design.

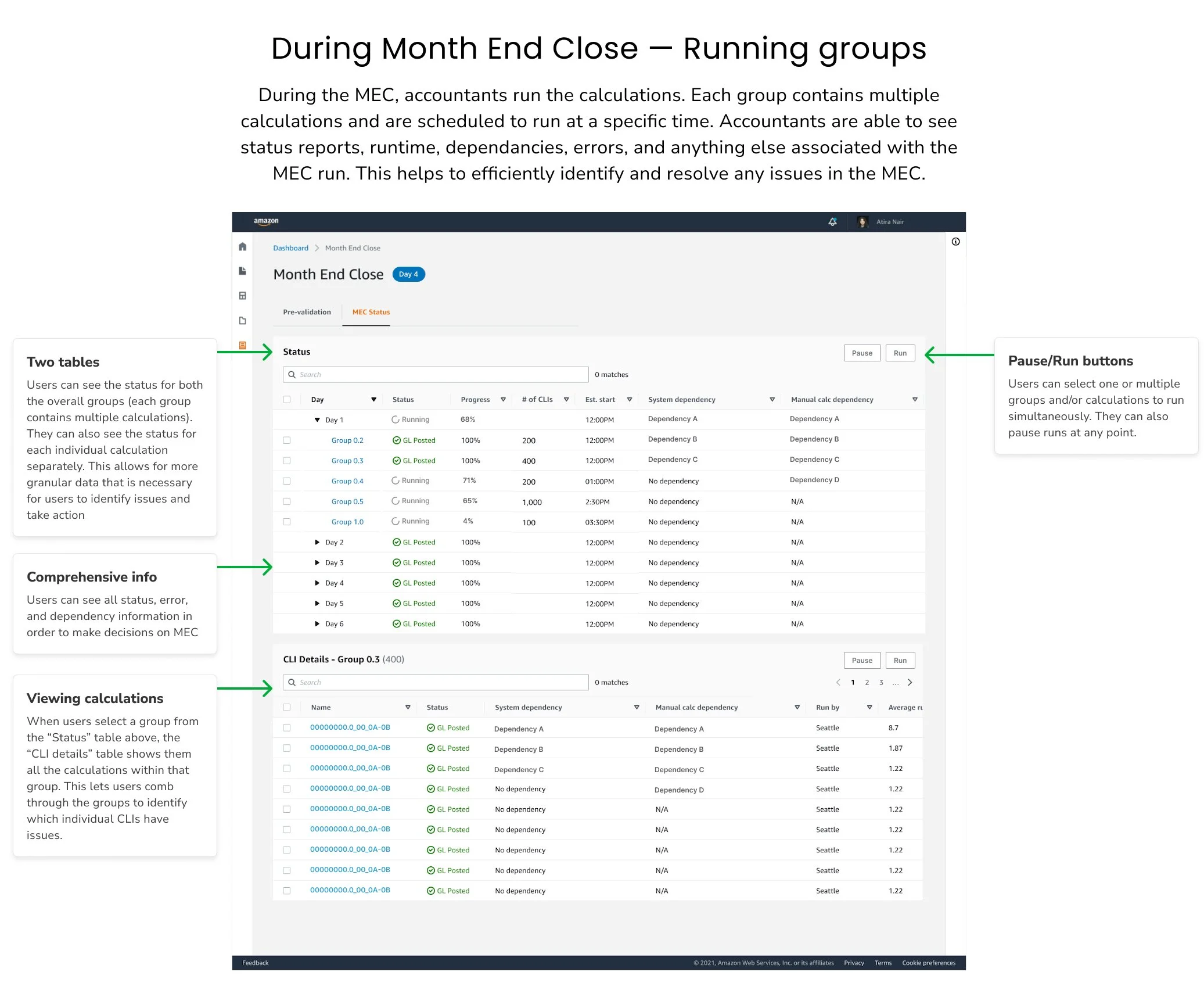

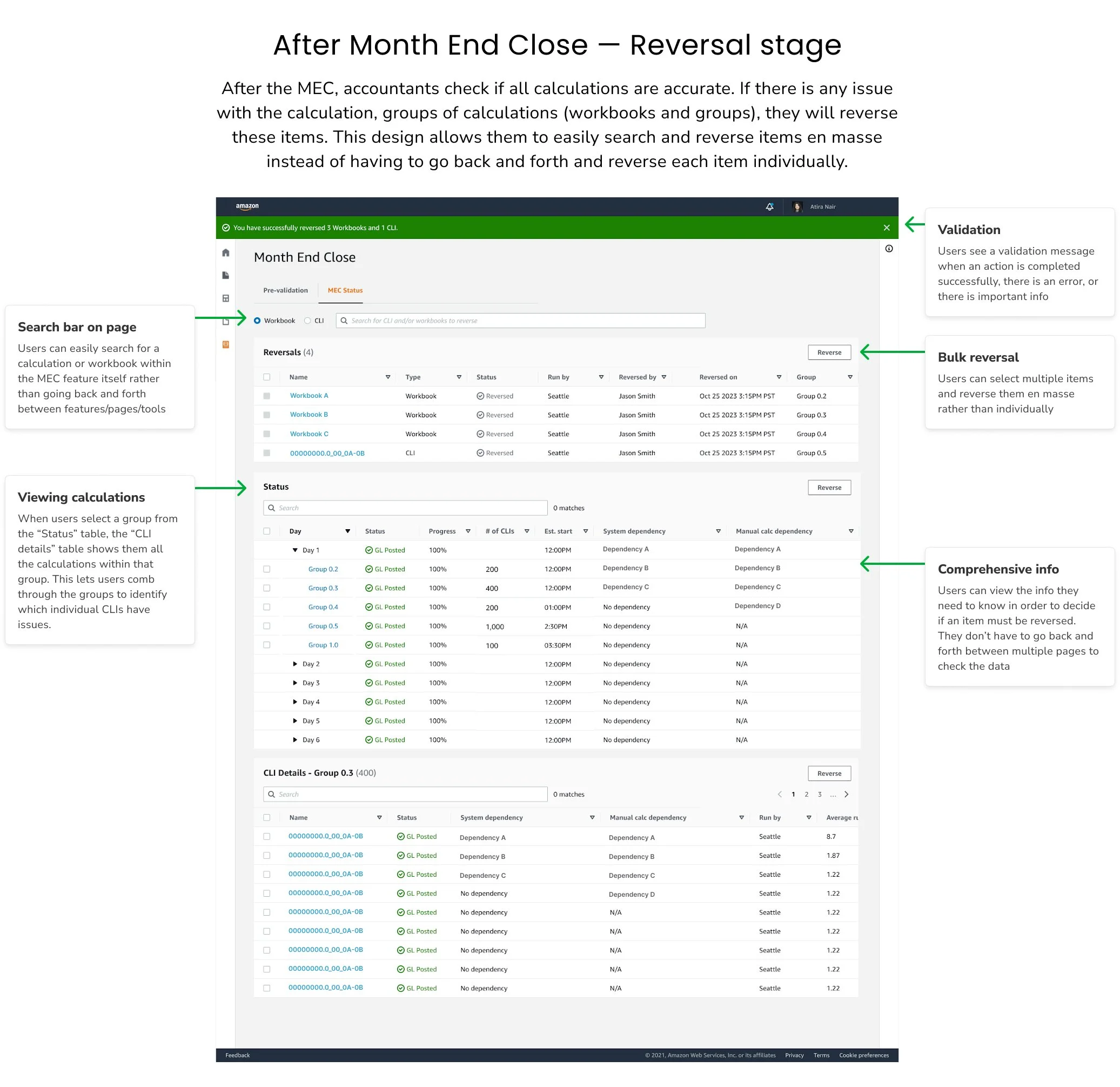

Instead of having one single view, we decided to have three seperate views during each stage of the MEC: 1) Before MEC, 2) During MEC, and 3) After MEC. Since each stage of the MEC requires vastly different tasks, it became important to include all these tasks in a way that didn’t overcomplicate the system. So rather than having all tasks within one view, I decided to have the system change its view automatically based on which stage of the process the accountants are in. This way, users only see tasks related to that stage rather than an overload of options.

Another major change was that in the “After MEC” view, users are now able to search for a workbook or CLI by name rather than comb through the records manually and individually reverse items.

Various other changes were made that upgraded usability, intuitiveness, and efficiency of the process.

Final design

Results

After implementation, users were very satisfied with the design. The Month End Close is now much more efficient to carry out, with less time needed for creating and managing automations. The reporting and tables provide visibility that ensures increased accuracy. Both timeliness and accuracy were addressed with this design.

Overall, users felt that:

There is now more visibility for the MEC, allowing users to identify and resolve issues more efficiently than before. Automation of tasks, usability additions, and easy navigation between items has drastically saved time for analysts. The design provides users the ability to quickly and accurately complete the Month End Close.

Reflections

This design allowed me to